Scotiabank

Created a compelling e-learning experience for Canada’s third-largest bank, driving an increase in advisor self-enrollment and product knowledge.

My Role

UX Designer, UI Designer

The Team

Project Managers, Graphic Designer, Copywriter, LX Strategist, LMS/QA Specialist, Client Stakeholders including L&D Managers

Tools

Adobe Illustrator, Adobe Photoshop, Articulate Storyline

Timeline

9 Weeks

Themes

Visual Design, Accessibility, Content Development, e-learning Development, UX/LX, Agile Process.

Learn

Background Research, Stakeholder Interviews, Content Intake, Client Test

Design

Content, Look, IA and Flow

Develop

Authoring of all e-learning materials and job aids

QA

Shipping files for testing on LMS

Go Live

Final feedback, deployment, and launch

PROJECT OVERVEIW

Building financial advisors’ confidence.

Scotiabank wanted to educate 1200 financial advisors on the benefits of a new Personal Redeemable GIC — which was set to launch in a few short weeks. Financial advisors were not confident in their understanding of the new product nor how to best position it for their clients.

To support financial advisor education, our team was tasked with creating e-learning modules designed to build their confidence and understanding. The course would be viewed primarily on desktop and available to both English and French-speaking users. Strict accessibility compliance was required.

My role was to storyboard and direct the visual design, plan the user flow, prototype interactions, and ultimately to set up the course and quizzes using Articulate Storyline.

1,200+

Employees would go on to take the course in two languages.

12 minutes

Seat time was allotted to minimize the cognitive load.

PROJECT GOALS

How might we increase the financial advisors’ preparedness and knowledge of the new PRGIC product, so they can confidently identify opportunities to discuss this new solution with their customers?

Discovery

Before diving into our brainstorming phase it was important to understand the technical constraints for our e-learning course. A technical discovery session quickly provided some key details to our build.

- The course will be deployed to an internal LMS

- The LMS could support Articulate Storyline 360

- SCORM calls would be used for course completion only

- Logging knowledge checks and quiz outcomes were not required

- Course bookmarking was to be enabled

- Design primarily for desktop

- Mobile was not a mandatory spec to the author for

- Accessibility guidelines must be followed

USER AUDIENCE

Understanding the Financial Advisors’ needs

By far the main feedback we were receiving from the financial advisors was that they were not confident in their understanding and in identifying appropriate opportunities to discuss this new GIC with their clients.

To ensure the course would satisfy the user needs my team planned to focus on three main actions:

- UNPACK the details of the new GIC product offering and where it most effectively meets client needs

- EQUIP Financial Advisors and Senior Financial Advisors with the product knowledge required to (and when to) effectively and compliantly recommend the GIC as a financial solution

- CONNECT the new product to Scotiabank’s overall Client Engagement Model

KEY RESEARCH INSIGHT

Breaking down the content – selling vs telling.

The course would not be mandatory for advisors, so to encourage participation it would need to be enticing and accessible. To this end, having the ability to take the course in one sitting was most desirable, and creating a course that could be completed within a 15 minute break period, or between appointments was favored. To minimize the cognitive load and allow advisors to quickly comprehend the GIC offering, the course content would be broken into the following sections:

- The Why – relevance to customer

- The What – features and benefits of the new product

- The How – Identify customer needs, position relevant advice, build a relationship

The course would adhere to adult learning principles through knowledge of results that are positive, authentic, and offer clear corrective feedback.

Build emotional engagement by orienting the e-learning to customer stories showing a positive progression – from concern and uncertainty to comfort, clarity of action, and a trusting relationship with an advisor.

Facilitate synthesis, learning transfer, and learner confidence with scenario learning around an authentic customer story that is central to the course structure.

Enhance retention through a job aid that facilitates recall of how best to stage the customer conversation aligned to the Client Engagement Model and is supported by coaching feedback.

Reinforce relevancy by emphasizing throughout the WIIFM for the customer and the financial advisor/bank.

Design

Our guiding principles

- The design should utilize the Scotiabank brand and leverage brand guidelines in other digital products

- Design should be engaging, provide clear instruction for users, and incorporate smooth transitions

- Focus on what will be most useful for the users, minimizing their time spent on the course

- Provide simple wayfinding through clear section highlights and inform user progress as % of completion

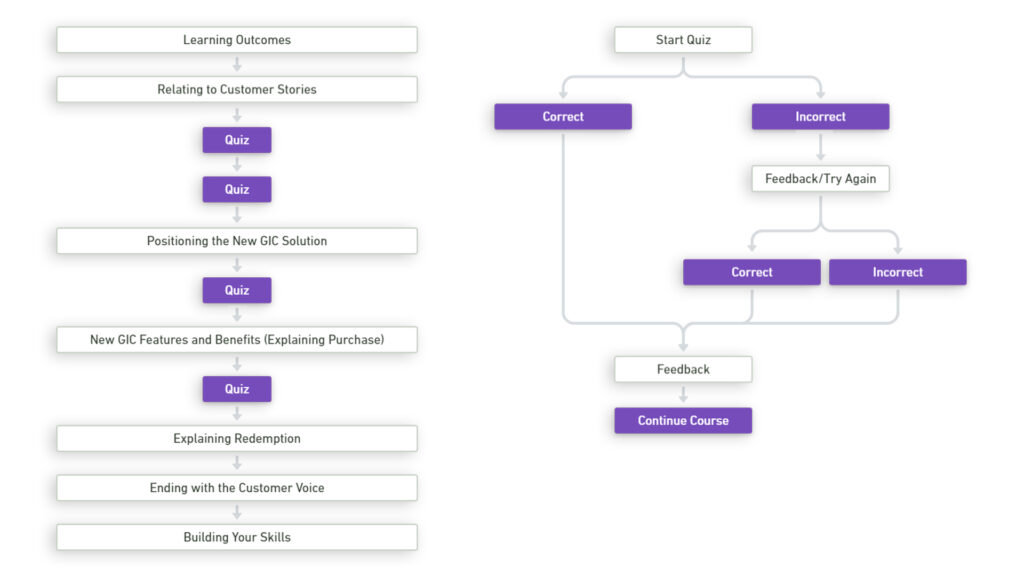

COURSE MAP AND FLOWS

Understanding the user journey.

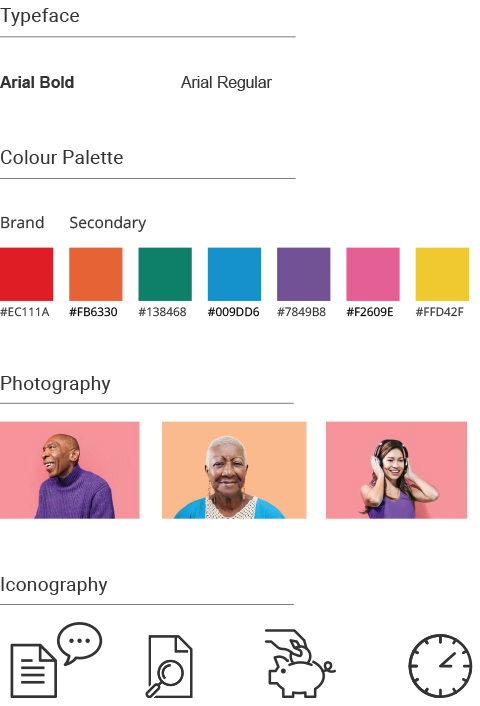

VISUAL DESIGN

Establishing the styles.

Since the course would be deployed to an enterprise intranet, where even web-safe fonts are often blocked, Arial was chosen as a standard system font.

The palette was made up primarily of corporate colours, leveraged from Scotiabank’s brand guide.

Photography also drew heavily from the Scotiabank brand palette. Backgrounds would need to be flat, and clothing would be edited and re-coloured as necessary using Photoshop.

To retain the brand standard, all icon styles would use outlines rather than fills.

PROTOTYPE

Testing interactions.

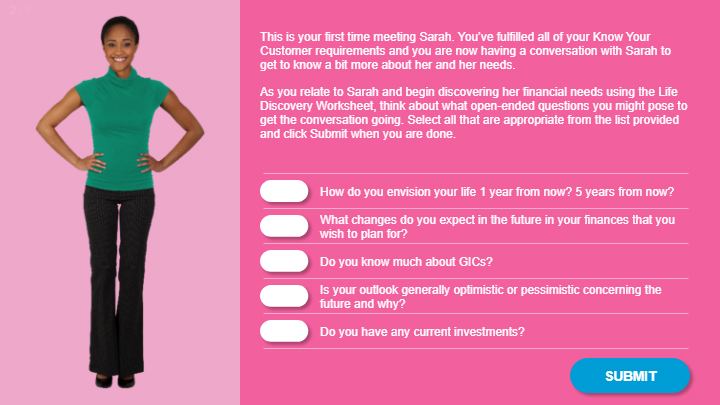

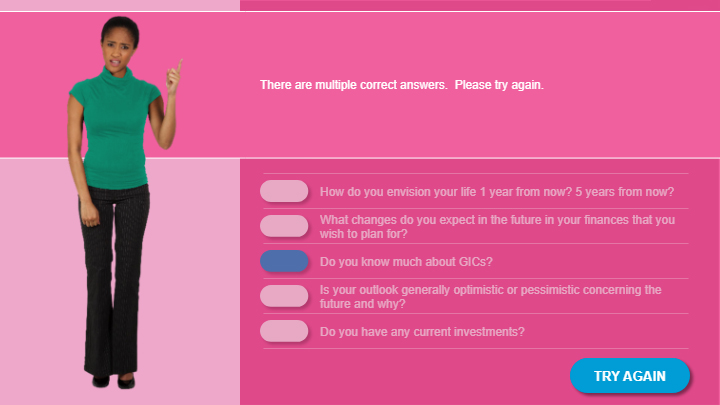

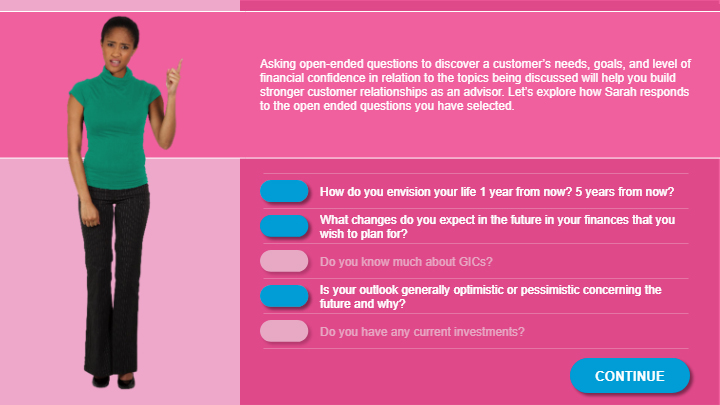

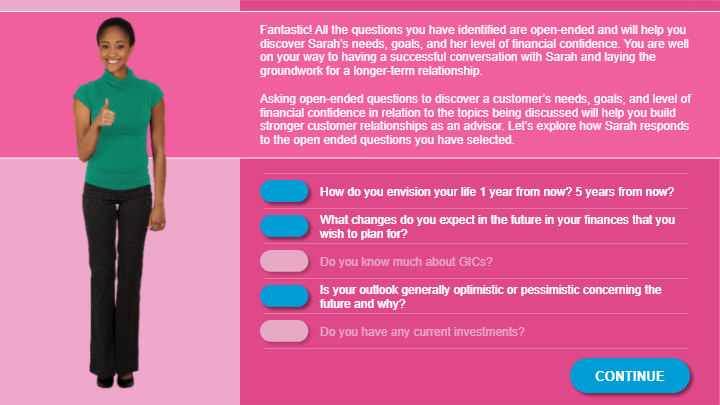

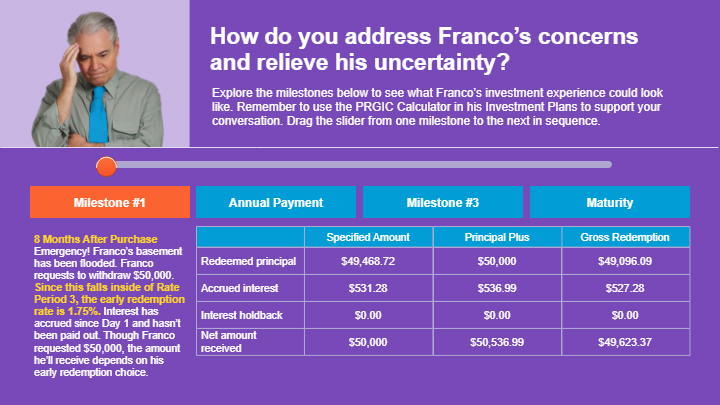

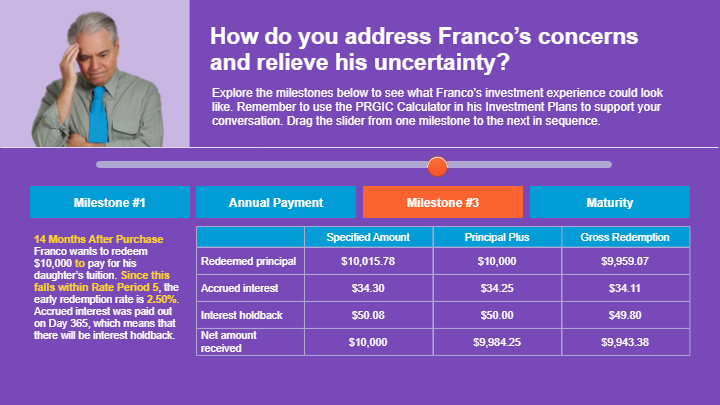

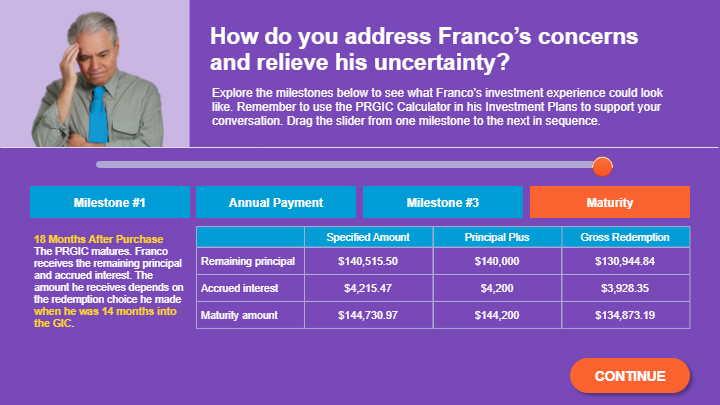

Example scenarios were designed to help FAs confidently and accurately offer advice to customers around the purchase of the new personal redeemable GIC product.

Knowledge checks help to level-set new customer interviews.

To minimize frustrations, the appropriate responses are revealed after the 2nd attempt.

Feedback overlays help to inform if selected responses require more consideration.

Scenarios prompt Financial Advisors to ask specific questions to help gauge whether a PRGIC is appropriate for their clients.

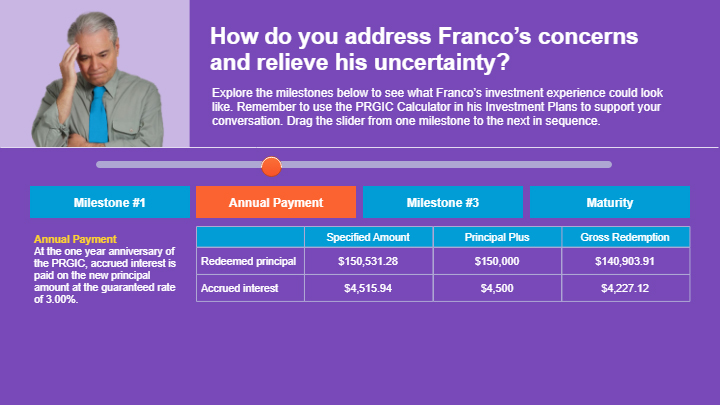

Data heavy content was broken up into bite-sized interactions, with prompts to continue appearing once each tab had been pressed.

Going Live

In general, the project ran smoothly and the team met all project goals. The end product resulted in an informative resource guide and an engaging e-learning module for employees at the bank. Despite a tight schedule and unexpected course completion troubleshoot during the QA stages, the project was able to launch on schedule.

RESULTS

What Went Well? Why?

- Teamwork and collaboration

- Communication and Responsiveness – Quick response from the team

- The team was able to start-up again quickly after a brief hold due to Covid-19

- Quick turnaround time

- Updates by our team were done very quickly

- Ability to work in an agile manner with multiple iterations

- QA standards were clearly communicated

- Flexibility with translation and turnaround time

- Feedback from the business line was timely, specific, and actionable

- Quality of product – Module has a unique look while maintaining Scotiabank standards

- Project management, clarity of roles, responsibilities, deliverables, and timelines

What Could We Do Better Next Time?

- More time allocated for testing early prototypes directly on the LMS

- More time for client-side QA testing (e.g. course completion issue) before moving to LMS

- More consultations with internal design and development team in the early stages

Contact me at chris@cgervais.ca